THOUGHT LEADERSHIP

A shift in asset management mindset brings new opportunities for hydropower

Compared with other clean energy technologies, hydropower is a long-distance runner. Many hydropower facilities have an expected lifespan of up to a century. An increasing challenge, however, is that many of these facilities are already well progressed on their life journey. With much of the world’s hydropower fleet already at or beyond mid-life, effective asset management is key to enabling these plants to perform successfully into the future.

But times change – so the way these plants operated decades ago may not be the way they can best serve us now or into the future. Changing energy markets will present different demands and new opportunities that extend beyond the operational states for which some hydropower facilities were originally designed.

In this context, asset management can do more than maintain the functional status quo; it can become a strategic enabler of change, breathing new life into old assets in a rapidly changing landscape.

New roles for hydropower

Energy markets are in transition. The pursuit of clean energy targets, the declining costs of wind and solar power, retirements of coal-fired power stations, and volatility in supply and pricing of gas are driving rapid change. With large amounts of wind and solar, the market needs storage to smooth supply. It also needs ancillary services that maintain a stable, reliable and resilient electricity grid. Hydropower can provide both.

To meet these market needs and to take advantage of emerging opportunities, the way we operate some hydropower plants will need to change. This calls for a rethink about how we want our assets to perform. The focus of asset management should now be shaped around maximising market opportunities as well as maintaining reliability while also optimising performance and dispatchability. This focus can be applied to designing new hydropower developments as well as overhauling aging assets.

Getting the strategy right

Over time, asset management has become a catalyst for continuous improvement regarding asset stewardship, evolving beyond reactive and fixed-interval maintenance, through to far more proactive, preventative and risk-based approaches guided by international standards (ISO 55000). However, even advanced asset management approaches tend still to be geared towards replacing ‘like for like’ to maintain desired levels of reliability, capacity and performance.

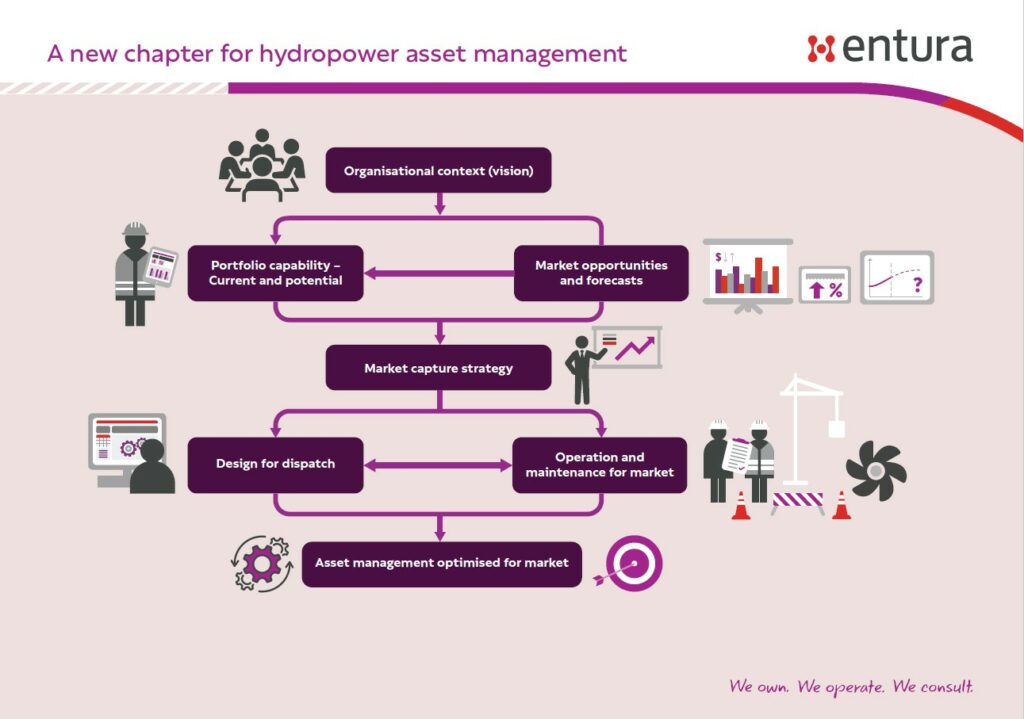

We believe that what’s needed now is a new chapter for asset management; one in which we employ all the sophistication of existing asset management approaches but add a new focus on ‘designing for dispatch’ to meet the market need whenever opportunities arise.

Here’s how that might look:

The starting point for the asset management strategy must be the organisational context. In other words, the asset management approach needs to enable the organisation’s vision, mission and business plans. But the organisational context cannot be a ‘set and forget’. It may shift due to changes in the broader operating environment, or it may change if there is a transfer of ownership of the organisation.

The next step is to understand the current and potential portfolio capability within the context of the organisational strategy. This means understanding how each particular machine and/or station is currently operating and performing, as well as how it would need to in future to deliver the desired outcome. Part of this process will be identifying any limitingfactors. These could be elements of the operational environment, such as weather patterns, rainfall events, or the relationship between one station and others in the cascade.

With a clear understanding of each asset’s performance and reliability requirements, asset management plans can be reviewed and adjusted to suit – or, in some cases, the asset may even need to be redesigned. The driving question behind the asset management strategy will be what each machine needs to be able to do in the market. Within the market opportunity, what are its strengths and weaknesses, and how will it interact with what the trading floor needs?

A market focus in practice

Let’s look at this in some real-world scenarios.

For an asset that largely performs as a baseload station, the asset management strategy may be to minimise the requirement for minor maintenance outages by designing in redundancy – such as having extra machines available in case of a failure.

Whereas, where an asset needs to operate mainly to meet peaks in the market, the components that suffer stress and wear from stop-start activities could be bolstered in their design, with failure modes addressed or eliminated. This may mean trialling new technologies in advance of the changed operation pattern, to be sure that the solution is robust. A change in style of operation from continuous generation to intermittent generation is also likely to call for changes in the monitoring and inspection regime.

It may also be worth changing the maintenance approach to better suit market dynamics. Rather than taking a machine out of service every 12 weeks to replace some relatively inexpensive components in a set, for example, it may be more cost effective to replace whole set at once and only take the machine down every 24 weeks to do so. The cost of the components may be outweighed by the extra revenue earned through less downtime.

We also have the opportunity to identify what part of the asset lets us down, and how we can engineer that in or out to be able to maximise the value of the market opportunity.

This is the approach that Hydro Tasmania is applying to the aging Tarraleah hydropower station, which previously operated inflexibly, based on the constant water volume that flowed slowly to it. A potential new design for Tarraleah may provide greater control of the outputs of the station, with controllable water flow and machines that are able to turn off and on rapidly as needed when the market requires.

The driver for design and asset management in this context becomes primarily dispatchability. Assets are designed and managed to meet the organisation’s vision and consequent dispatch strategy.

Asset owners that are thinking about dispatch are likely to want to take a lead role in the design phase, working together with original equipment manufacturers (OEMs) to design and customise machines to best meet the dispatch strategy and take advantage of market opportunities.

The outcome of the process we’ve outlined here should be an asset management program that optimises assets for the market and maximises their value for current and future operations. By optimising both asset management and dispatchability, hydropower assets can continue to operate efficiently and reliably, and to make very significant contributions to the stability and sustainability of the grid.

If you would like support to understand your dispatch opportunity, iron out barriers, and set up your operations and maintenance strategies to be dispatch-ready, contact Richard Herweynen or Phillip Ellerton.

About the author:

Leigh Smith is a specialist consultant with extensive experience and proven ability in asset management, condition assessment, risk management and project management in the power sector, particularly hydropower. He has over three decades of practical experience with hydropower assets and has successfully delivered and project managed many major projects in Australia and internationally. Leigh has produced numerous asset management plans to support financial modelling and feasibility of major hydropower projects, as well as detailed 30-year asset management and maintenance plans that have been critical to the progression of projects around the world.

MORE THOUGHT LEADERSHIP ARTICLES

June 1, 2023